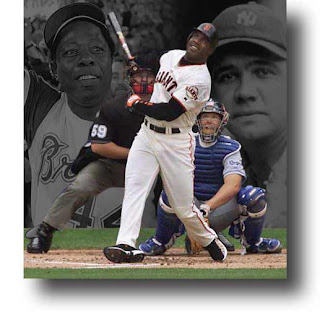

Barry Bonds belts No. 756 off of Washington's Mike Bacsik to pass Hank Aaron and become Major League Baseball's new all-time home run leader

How does a self-respecting, tried and true, seams enthusiast not, at least, mention the passing of the most prestigious crown in all of sports? There has been so much hype, so much scrutiny, and so much anticipation surrounding this event that it's hard to write anything about it that hasn't already been written 756 times.

Barry Bonds... blah, blah, blah... steroids... blah, blah, blah... big, fat jerk... blah, blah, blah... asterisk... blah, blah, blah... BALCO... blah, blah, blah... and on and on and on. I think what Bonds has done is unreal. No one thought that Aaron's record would ever be broken. In fact, it took 26 years. And keep one thing in mind: Barry Bonds isn't finished. It's not remotely inconceivable that he finish his career in the 800 HR range.

Due to the sordid nature of the entire ordeal, however, I'm more intrigued by a rather abstract angle of this story. Mainly, the fan that caught the ball.

Stopping over in San Francisco on his way to Australia, proudly sporting his Mets jersey, Matt Murphy of Queens, NY "won the lottery" as he smothered Barry Bond's record-breaking 756th bomb and dove under the bleacher seats to wait out the ensuing human tidal wave. Everyone knows that the ball is worth hundreds of thousands of dollars, but what interests me is the position the government takes on the value of the ball before it ever exchanges hands.

Once Murphy took possession of the ball and it was his ball, it became income to him based on its value as of that day. Even if he chooses to keep the ball himself and never profit from it, he will still owe taxes on a reasonable estimate of its value (estimated to be worth approximately $600,000). Does that seem ridiculous to anyone else? No matter what, the government profits off Barry Bonds' achievement regardless of what actually happens to the ball. So now that Matt Murphy finds himself in the highest income tax bracket there is, he will be taxed around 35%, or about $210,000 on a $600,000 ball... even if he keeps it. And if that's not already twisted enough, capital gains taxes could also be levied in the future as the ball gains value.

That was an expensive catch. I mean, I'm sure the guy will sell it at auction and walk away with something in the neighborhood of $380,000. Which is probably about $370,000 more than the college student would have made this year.

So everybody wins, really. Matt Murphy wins b/c he comes away with nearly $400,000 (unless he keeps the ball, in which case he loses big-time); Barry Bonds wins b/c he's the new home run champ; and the IRS wins b/c they profit off something that has absolutely nothing to do with them, the government, income, or anything related to the US economy in any way. They win because they say they win, God love 'em.

I'd love to see Matt Murphy keep the ball, refuse to pay taxes on a $4.00 baseball (allegedly worth $600,000) and go to prison for tax evasion. Not because I want the likable kid to go to prison, but that would be even more ridiculous than taxing him on a "reasonable estimate" of the ball's value.

Talk about justice being blind...

No comments:

Post a Comment